Investing in a hood stock can be a risky endeavor. Although it may seem appealing, there are many factors to consider before putting money into a particular hood stock. Here are some tips to help you make your decision.

Market cap

Using a market cap calculator is an effective and nifty way to understand how much a company is worth. The market cap is a fancy term for the total of a company’s assets. In general, the market cap ranges are skewed higher as asset prices rise. This is a great way to evaluate a company’s valuation and to get an idea of what its stock is worth in the market.

The market cap isn’t the only thing that counts, however. An excellent company to watch is Robinhood Crypto, LLC, a cryptocurrency trading firm that offers commission-free trades of cryptocurrencies such as bitcoin and Ethereum. The company also operates Robinhood Securities, LLC, a brokerage clearinghouse that enables customers to buy and sell stocks and ETFs on the secondary market.

IBD Stock Checkup

Using a service like IBD Stock Checkup to help you find the right stocks to invest in can be a great way to save you time and effort. This service allows you to pull up stock charts, see potential buy points, and evaluate stock ideas based on IBD SmartSelect(r) Ratings.

The IBD website will show you the top stocks in your industry and information on how to get the most out of your investment. The site also features an annotated technical chart that explains entry and exit points, stop loss levels, and other technical strategies.

The best part is that you can access IBD Stock Checkup at any time from anywhere. They even have a mobile app, making it easier to find and track your stock ideas. The service also features an email and chat customer service center. In addition, you can expect a responsive customer support staff ready to answer your questions from 9 am to 5 pm Eastern Time.

IBD Composite Rating

Using the IBD Composite Rating can be helpful when evaluating stocks, but you should use this information in conjunction with other metrics. For example, it can help you filter screens, find a store with a strong run or get a glimpse of the fundamentals of a particular stock.

The IBD Composite Rating comprises the IBD SmartSelect Ratings, Industry Group Relative Strength Rating, Earnings Per Share Rating, and the SMR Rating. Each of these measures how a stock compares to other stores in its category. If a stock’s IBD SmartSelect Rating is high, it outperformed 95% of other stores in its industry group.

IBD’s Ratings are a quick way to check stocks. They can help you separate leaders from laggards. They provide scores between 1 and 99, with higher numbers indicating a more robust overall performance.

Performance report

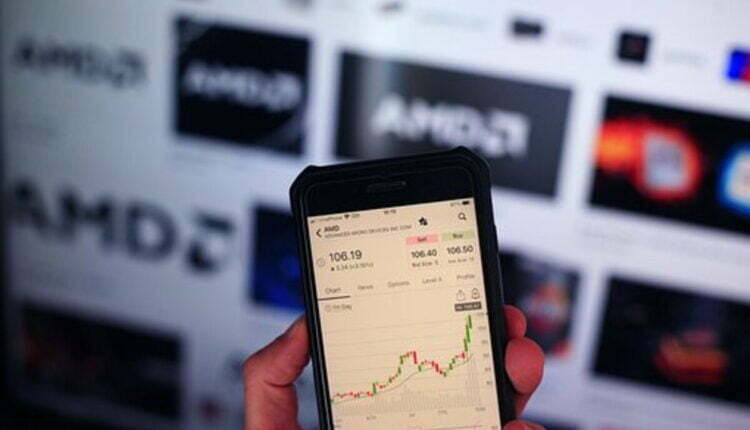

HOOD is a financial services company that provides commission-free trades of ETFs and cryptocurrencies through its mobile app. The company recently announced its financial results for the third quarter. Its net revenue increased 14% from the second quarter, but its loss widened to $120m from $73m.

As far as the performance report for HOOD stock goes, the company has underperformed in the market this year, but the company has managed solid sales growth in the past few quarters. As a result, analysts expect the stock to gain 40% over the next year. But the store has a long way to go to reach post-IPO highs.

The IBD Composite Rating is a measure of a stock’s fundamentals. This list contains stores with a low IBD Composite Rating, which indicates that the stock hasn’t performed well.

Risks of investing in hood stocks

Investing in Robinhood stocks may offer an excellent long-term return, but the risks are considerable. The company has a short history and a business model that relies on a high volume of transactional activity. This could eventually lead to the need to dilute shareholders to raise capital.

Many investors have complained about the structure of the company. Its dual share class offers insiders more power but makes it harder for regular investors to participate in the firm’s decisions.

The company sells a large percentage of its shares to institutional investors. However, it also allows retail investors to participate in the IPO. This is a unique move. This may encourage new investors to stay with the company long-term.

One of the most significant risks is the company’s payment for order flow business model. The company receives a small compensation from market makers in exchange for the right to execute a transaction. There have been several issues with the business model, and the SEC has been looking into it. The company could be affected if legislation is passed that prohibits Payment for Order Flow.