Whether you’re new to Forex markets or have a few years of experience under your belt, there’s a lot to learn about the world of FX. You’ll need to know which Forex brokers offer the best spreads, how to choose a trading platform and how to avoid common pitfalls.

Minimum deposit

Choosing a Forex broker is crucial if you want to get involved in the financial markets. A foreign exchange broker acts as an intermediary between you and the interbank, buying and selling currency. Often, a broker will have more than one trading account, which can offer you a variety of ways to trade.

To open an account with a forex broker, you will need to have sufficient trading capital. More capital is better if you want to trade larger positions. Alternatively, you can choose to trade with a leveraged product, which magnifies your potential profit. Leveraged products can be a risky strategy, though. It is important to understand the risk of trading and to seek independent advice before deciding to trade.

To trade with a leveraged product, you will need to have enough margin in your account to cover the amount of money you are lending to the broker. For example, you will need to have $1 in margin for every $1000 in currency.

Trading platforms

Whether you are new to trading, or you are a seasoned trader, you need to understand the differences in trading platforms. One of the most popular choices is the MetaTrader 4 (MT4) trading platform.

The MetaTrader 4 is a powerful trading platform that comes with advanced charting and order management features. It’s also available as an Apple app and web-based application. This platform delivers raw pricing and trading without the need for a Dealing Desk.

MT4 offers a customizable, easy-to-use trading environment. Its advanced order management features include trailing stops and a stop-loss order. This order is placed with the broker to protect you from losing a security position.

MT4 comes with currency trading as well as CFDs and spread betting. The platform also includes advanced charting tools and a variety of indicators.

Regulations

Currently, the world’s largest financial market is the foreign exchange market. It accounts for about $4 billion in trades each day. It involves currencies such as the euro, the dollar, the British pound, the Japanese yen, and the Swiss franc.

Traditionally, the FX market was seen as an exclusive domain for the largest banks. However, recent events have changed that. Large banks are no longer the only participants in the FX market. Today, there are also brokers, asset managers, and corporate treasury departments.

There are several regulatory bodies across the world that oversee FX markets. In the United States, the Federal Reserve and Treasury Department are both highly focused on the industry. They monitor brokers for suspicious activity. They also issue alerts about individuals and financial services firms.

Fees for inactive accounts

Even though you’re not trading, you may still face an inactivity fee from your broker. This is a common practice among brokers, but you may not be aware that you’re being charged. If you’re interested in trading forex, it’s important to be aware of these fees and to understand how they can affect your trades.

Inactivity fees are a way for brokers to make money from accounts that haven’t traded in a while. The fees are meant to encourage account holders to get active again. Brokers make their money from commissions on trades, spreads, and the net of gains and losses. If you don’t trade, you won’t make money from your account, so it’s important to avoid these fees.

Inactivity fees can be found in the fine print of your trading agreement, but many brokers do not publicize them. There may be a few exceptions to this rule. If you’re looking to trade forex, you may want to check your trading agreement to make sure that inactivity fees aren’t charged to your account. You may also want to check with your local regulators to see whether or not you’re allowed to be charged such fees.

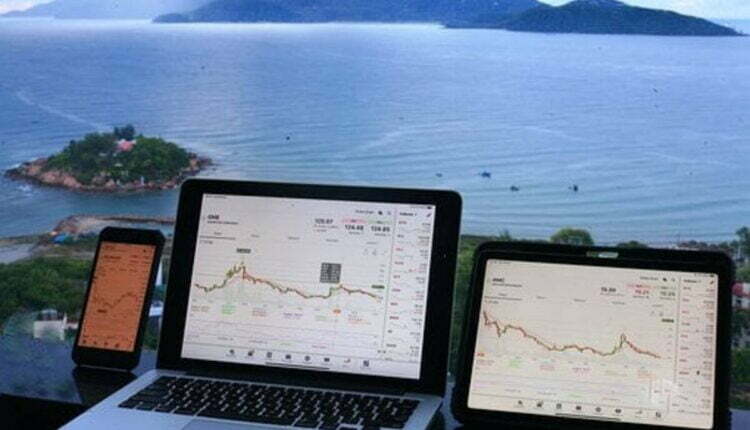

Mobile apps

Considering how volatile the forex market can be, staying on top of the latest trends and developments in this competitive sector is a must. This is where the FX Global Markets mobile app comes into play. From news to market analysis to in-depth market research, the app has got you covered. Whether you’re a beginner or a seasoned pro, the app has something to suit your trading style.

The FX Markets app features the smartest order execution engine on the market and a plethora of fixed-income products. However, the app does not support streaming data on multiple devices. However, it’s worth checking out, especially if you’re looking for a mobile trading solution that will suit your needs. The app is available for iOS and Android devices and has a ton of useful features and functions.